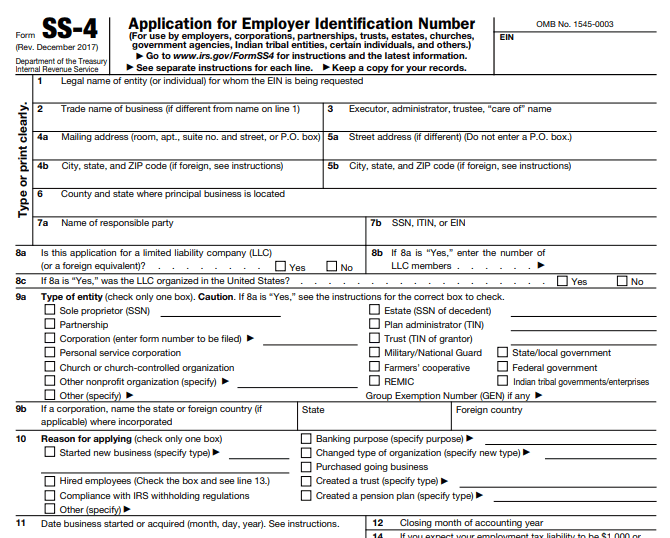

Fillable Form SS-4

The SS-4 Form is used to apply for an employer identification number. The employer identification number is composed of nine numbers, and is used for tax filing and reporting purposes.

What is Form SS-4?

Form SS-4, officially the Application for Employer Identification Number (EIN), is an Internal Revenue Service form to request an EIN. An EIN is a 9-digit number series assigned to a business for tax filing and reporting purposes used by the IRS to designate a business identifying number.

Employers (including corporations, partnerships, and sole proprietors), estates, trusts, government agencies, nonprofit organizations, and certain individuals (including sole proprietors) and other entities listed on Form SS-4 may apply for an EIN.

The EIN is solely for business activities only and not an alternative to a Social Security number. No fees should be paid upon request of an EIN number.

For sole proprietors, only one EIN is needed no matter how many businesses they operate.

How to Fill Out Form SS-4?

Here are the important details to provide when applying:

Line 1: Legal name of entity

Provide the legal name of the entity as mentioned in any other legal document or card. This information is required.

Line 2: Trade name of business

Provide the name of your business if different from line 1.

Line 3: Name of Executor, administrator, trustee, “care of”

The format should be First Name, Middle Initial, and Last name.

Lines 4a–b: Mailing address

If the address is outside the United States, provide the city, province or state, postal code, and name of the country. You must not abbreviate any name. Provide the address of executor, trustee, or "care of" person, if correspondence is to be made by others.

Lines 5a–b: Address

Provide your complete address.

Line 6: County and state where principal business is located

Provide the location of your principal business.

Lines 7-a,b: Responsible party

Provide the name of the responsible party based on the type of entity.

The "responsible party" of an organization is the person who has a level of control over the funds of the company. He or she controls the direction and disposal of funds and assets.

If the business is a corporation, then provide the principal officer’s name.

If the business is a partnership, then provide the general partner’s name.

If the business is solely controlled by the owner, then fill in with the owner’s name.

If the business is a trust, then provide the principal officer’s name.

Line 8a

Select “Yes” or “No” depending on your circumstance. If you select "Yes," specify your LLC member number.

Line 8b

If the entity belongs solely to a couple who decides to treat the company as a disregarded entity, enter "1."

Line 9a: Type of Entity

Select the box that has the exact description for your company type (Sole proprietor, Estate, Partnership, Plan administrator, Corporation, Trust, Personal service corporation, Military or National Guard, State or local government, Church or church-controlled organization, Farmers’ cooperative, Federal government, REMIC, Indian tribal governments/enterprises or other nonprofit organization). If not included in the choices, select others, and specify it on the space provided.

Line 10: Reason for applying

Select one reason for applying EIN (started a new business, changed the type of organization, purchased a going business, hired employees, created a trust, compliance with IRS withholding regulations, or created a pension plan).

Line 11: Date business started or acquired

Provide the date you started or acquired your business in month, day, year format.

Line 12: Closing month of accounting year

Provide the closing month of your accounting year.

Line 13: Highest number of employees expected

Provide the highest number of employees expected in the next 12 months. If no employees are expected, write “0” and do not answer line 14.

Line 14

Check the box if you expect your employment tax liability to be $1,000 or less.

Line 15

Enter the first date wages or annuities paid in month, day, year format.

Line 16: Principal activity of business

Select the box that gives the most precise description of the principal activity of your business.

Line 17

Enter the major product or service your business provides or sells.

Line 18

Select the appropriate answer according to your EIN status. If you select "Yes," write the previous EIN in the space provided.

Submission

You may file SS-4 online by fax or by mail.

You can complete the SS-4 on the IRS’ website through their online portal. Once you submit the application you will have to wait to receive your EIN.

If you choose to file via mail, choose from the following

If your business address is in the U.S., use this address:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If your business address isn’t in the U.S. or you don’t have a place of business, use this address:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Once mailed, you can expect to get your EIN back by mail within four weeks.

If you choose to file this form via fax, choose from the following:

If your business address is in the U.S., use this number:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

If your business address isn’t in the U.S. or you don’t have a place of business, use this number:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Fax: (855) 215-1627 (within the U.S.)

Fax: (304) 707-9471 (outside the U.S.)

Provide your fax number to the IRS. You will receive your EIN via fax within four business days.

Tips: