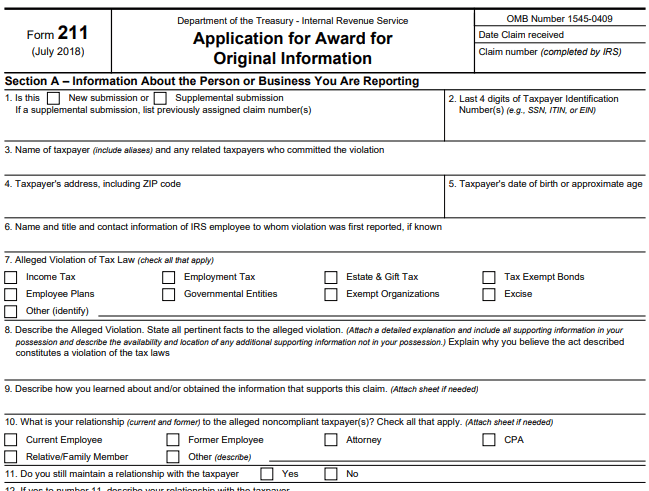

Fillable Form IRS Form 211

Form 211 or "Application for Award for Original Information" is used to file unpaid taxes to the IRS and must be submitted by a Whistleblower that will claim a reward for giving information for committing tax evasion.

What is Form 211?

Form 211, Application for Award for Original Information, is an Internal Revenue Service (IRS) form used by a “whistleblower” who wants to claim a reward for providing information on tax evasion to the U.S. government. If the IRS can recover funds based on a whistleblower’s or informant’s claim, the whistleblower or informant will receive a percentage of the funds recovered.

An informant must file a formal claim for award by completing and sending the IRS Form 211 to be considered for the Whistleblower Program. The Whistleblower Office has responsibility for the administration of the whistleblower award program under section 7623 of the Internal Revenue Code.

Section 7623 authorizes the payment of awards from the proceeds of amounts the Government collects as a result of the information provided by the whistleblower. The 211 IRS Form rewards can be substantial, up to 30% of any additional tax, penalties, or other amounts the IRS collects as a result of the information.

Send the completed 211 Form IRS along with any supporting information to:

Internal Revenue Service

Whistleblower Office - ICE

1973 N. Rulon White Blvd.

M/S 4110

Ogden, UT 84404

How to fill out Form 211?

Using PDFQuick, you can electronically fill out and download a PDF copy of the 211 Form in minutes. Fill it out by following the instructions below.

Section A – Information About the Person or Business You Are Reporting

Item 1

Mark the appropriate box indicating whether this is a:

If you have not previously submitted a Form 211 regarding the same or similar non-compliant activities, or the taxpayer identified in this information has no known relationship to the taxpayer identified in a previously submitted Form 211, mark the box for “new submission.”

If you are providing additional information regarding the same or similar non-compliant activities, and are identifying additional non-compliant activities by the same taxpayer, mark the box for “supplemental submission.”

If you are identifying additional taxpayers involved in the same or similar tax non-compliance identified on a previously submitted Form 211, and those additional taxpayers are related to the taxpayer identified on a previously submitted Form 211, mark the box for “supplemental submission.”

If you marked the “supplemental submission,” enter a list of previously assigned claim numbers.

Item 2

Enter the last four (4) digits of the taxpayer’s identification numbers (for example: Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN)).

Item 3

Enter the name of the taxpayer, including aliases and any related taxpayers who committed the violation.

Item 4

Enter the taxpayer’s address, including the ZIP code.

Item 5

Enter the taxpayer’s date of birth or approximate age.

Item 6

If you reported the violation to an Internal Revenue Service (IRS) employee, enter the employee’s name, title, and the date the violation was reported. If known, enter the IRS employee’s contact information.

Item 7

Mark the appropriate boxes for the alleged violation of the tax law. You may select:

Item 8

Describe and state all pertinent facts to the alleged violation. Explain why you believe the act described constitutes a violation of the tax laws. Attach all supporting documentation (for example, books and records) to substantiate the claim. If documents or supporting evidence are not in your possession, describe these documents and their location.

Item 9

Describe how you learned about and/or obtained the information that supports this claim. Attach an additional sheet, if needed.

Item 10

Mark the appropriate boxes indicating your relationship (current and former) to the alleged non-compliant taxpayer. You may select:

Item 11

Mark the appropriate box indicating if you still maintain a relationship with the alleged non-compliant taxpayer. You may select:

Item 12

If you marked the “Yes” box on Item 11, describe your relationship with the taxpayer.

Item 13

Mark the appropriate box indicating if you’re involved with any governmental or legal proceeding involving the taxpayer. You may select:

Item 14

If you marked the “Yes” box on Item 13, enter a detailed explanation. Attach an additional sheet, if needed.

Item 15

Describe the amount of tax owed by the taxpayer. Provide a summary of the information you have that supports your claim as to the amount owed (for example: books, ledgers, records, receipts, tax returns). Attach an additional sheet, if needed.

Item 16

Enter the tax year and dollar amounts, if known.

Section B – Information About Yourself

Item 17

Enter your name.

Item 18

Enter your date of birth, following the format: MM/DD/YYYY.

Item 19

Enter the last four (4) digits of your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Item 20

Mark the appropriate box indicating if you are currently an Internal Revenue Service (IRS) employee. You may select:

Item 21

Mark the appropriate box indicating if you are the spouse or a dependent of an Internal Revenue Service (IRS) employee. You may select:

Item 22

Mark the appropriate box indicating if you are currently an Internal Revenue Service (IRS) contractor. You may select:

Item 23

Mark the appropriate box indicating if you are a Federal, State, or Local Government employee. You may select:

Item 24

Enter your complete address, including your ZIP code.

Item 25

Enter your telephone number, including your area code.

Item 26

Enter your email address.

Item 27

Information provided in connection with a claim under this provision of law must be made under an original signed Declaration under Penalty of Perjury. For joint or multiple claimants, Form 211 must be signed by each claimant.

By signing you declare under the penalty of perjury that you have examined this application, all accompanying statements, and supporting documentation, and, to the best of your knowledge and belief, they are true, correct, and complete.

Affix your signature.

Date

Enter the date you signed the form.